11 dollars an hour 40 hours a week after taxes

Let Us Find The Credits Deductions You Deserve. Enter your hourly wage - the amount of money you are paid each.

New Jersey Nj Tax Rate H R Block

If you work 20 hours per week for 52 weeks you would earn 280 per week for a total of 14560 per year.

. So on the top end you would take. Its not all bad news however. The calculation is based on the 2022 tax brackets and the new W-4 which in 2020 has had its first major.

His income will be. To calculate how much you make biweekly before taxes you would multiply 40 by 40 hours and 2 weeks. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

At the same time those who work for 35 hours per week this is still considered part-time will make 1400 per week ie 72800 per year before taxes. Clothing Expenses Some jobs require workers to purchase and wear uniforms and these clothing costs will further reduce a persons real hourly wage. Adding those extra work hours or tips can drastically.

Is 11 an hour good pay. This result is found by multiplying 10 x 40 x 52 to get the final annual amount. For people with alternating work schedules like doctors or nurses to calculate their average hours they would add 2 weeks together then divide by 2.

If you do any overtime enter the number of hours you do each month and the rate you get. 14 an Hour is How Much a Year. Paying a tax rate of 25 and working full-time at 40 hours a week you would earn 2400 after taxes.

More information about the calculations performed is available on the about page. Following the same formula youll end up making 800 per week or 41600 per year before taxes. Answer 1 of 8.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Its free to sign up and bid on jobs. Search for jobs related to 12 dollars an hour 40 hours a week after taxes or hire on the worlds largest freelancing marketplace with 21m jobs.

Use this easy calculator to convert an hourly wage to its equivalent as an annual salary. We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund. In this case you would make a 40 hours x 52 weeks operation which gives you 2080 hours a year.

Now you only need to multiply 2080 hours for 13 an hour and you get 27040 a year. Child Care 40 hours of child care a week reduces a workers real hourly even further sometimes by as much as 350 an hour. 10hour is in the bottom 10 of wages in the United States.

This calculator is intended for use by US. You can make 40 an hour. 40 an hour is how much a week if you work for 20 hours.

Convert 11 dollars an hour to yearly salary. Likewise 36 plus 48 is 84 hours which becomes 42 after dividing by 2. If your are just looking for a ballpark estimate here is how I do it.

In the Weekly hours field enter the number of hours you do each week excluding any overtime. In the equation the 10 stands for 10 dollars an hour 40 means 40 hours a week and 52 stands for 52 weeks in a year. If I have health insurance and other benefits withheld I always figure I will take home about 6065 If I just have basic deductions I figure I will take home about 70.

On the other end of that spectrum if you work 35 hours a week which is still technically part-time you would make. To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left-hand table above. Ad TurboTax Has Your Back.

Hourly wage 2500 Daily wage 20000 Scenario 1. 10 an hour is 20800 annually. It can also be used to help fill steps 3 and 4 of a W-4 form.

It depends on how many hours you work but assuming a 40 hour work week and working 50 weeks a year then a 11 hourly wage is about 22000 per year or 1833 a month. An employee receives a hourly wage of 15 and he works 40 hours per week which will result in the following earnings. See where that hard-earned money goes - Federal Income Tax Social Security and other deductions.

They essentially mean the same thing just phrased slightly differently. So for example 3 days plus 4 days is 7 days which divided by 2 is 35 days in their average work week. Weekly salary 60000.

A project manager is getting an hourly rate of 25 while working 8 hours per day and 5 days a week. This is your average gross income every week if you make 10 an hour weekly. 14 dollars annually part-time is between 14560 and 25480.

People working overtime taking on extra work or receiving tips need to add them to the total number. Before and After Taxes.

What S Hidden Under The 15 Minimum Wage Higher Taxes Rutgers Business School

28 000 After Tax 2022 Income Tax Uk

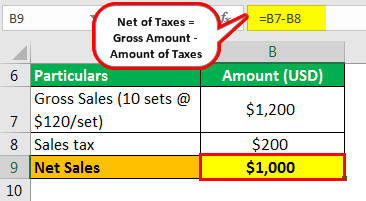

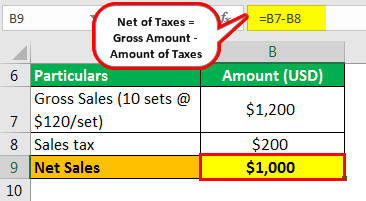

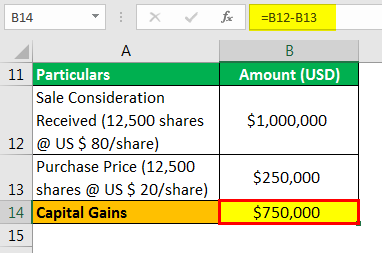

Net Of Taxes Meaning Formula Calculation With Example

Net Of Taxes Meaning Formula Calculation With Example

I Make 800 A Week How Much Will That Be After Taxes Quora

10 An Hour Is How Much A Year Before And After Taxes The Next Gen Business

Net Of Taxes Meaning Formula Calculation With Example

Paycheck Taxes Federal State Local Withholding H R Block

Here S How Much Money You Take Home From A 75 000 Salary

How Much Do I Need To Make Hourly To Take Home 1 000 After Taxes Weekly Quora

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

The Best Tool For Tax Planning Physician On Fire

Us Hourly Wage Tax Calculator 2022 The Tax Calculator

How Much Will I Have To Pay In Taxes As An Intern In New York City Quora